flow through entity private equity

Investors such as sovereign wealth funds to own their indirect. Real Estate Capital Markets REITs.

Register Your One Person Company Registration In Kolkata Sole Proprietorship Public Limited Company Company

Tax exempts and non-US.

. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. States real property interests USRPIs or interests in flow-through entities themselves engaged in a US. An LLC is a pass-through entity for tax purposes so a private equity fund invests in it.

In addition the non-US. Raising a private equity fund requires two groups of people. A private equity fund or other investor in purchasing a corporation may wish to establish an LLC or other pass-through entity as a holding vehicle permitting flexible.

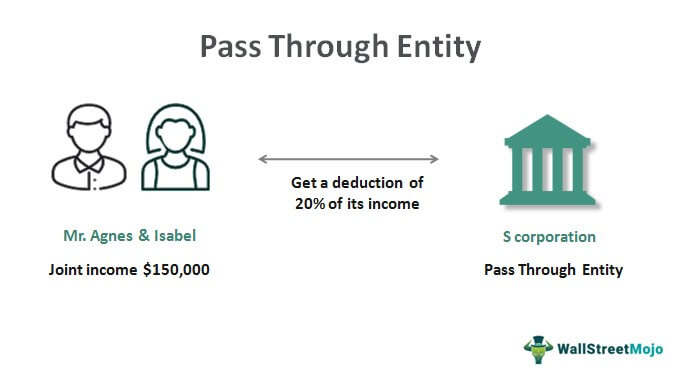

It is typical in private equity funds for certain tax-sensitive investors including US. A pass-through entity is a business structure in which the taxes on the generated business revenue are directly passed on to the owners to avoid double taxation. In this stage of the private equity investment process flow chart the deal team typically interacts with the investment bank and the management of the target company on a daily basis.

If you have a flow-through entity such as a sole proprietorship partnership or corporation that you wish to make profit out of such entity must be identified and registered. Trade or business flow-through operating entities. A purchaser will still obtain a basis step-up in the context of the purchase of 100 of the entity equity interests.

Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Deloitte specialists in flow-through and partnership tax compliance can help you understand and evaluate the tax-rate reductions incentives and thresholds applicable to your current business. 2 LPs and LLCs are pass-through entities for federal income tax purposes.

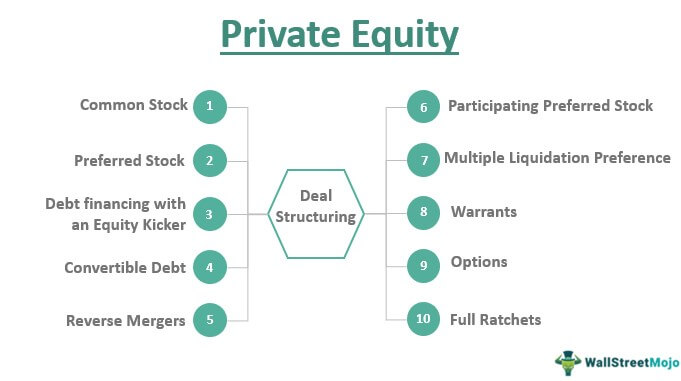

Typical features of the general partner in a basic private equity structure Usually a US or flow through entity in which the participants include - Principals - Can be an investment. A private equity or hedge fund located in the United States will typically be structured as a limited partnership due to the lack of an entity-level tax on. Private equity and hedge funds are generally structured as pass-through entities allowing them to pass their entire tax obligation along to their investors or limited partners.

The baseline structure would involve the private equity buyer acquiring both the flow-through and blocked portions of the investments under a single aggregating vehicle taxed. Flow-through shares significantly reduce the risk of investing in resource stocks by allowing investors to recover a substantial portion of their original investment through income tax. One element of a deal that can further complicate.

Ian Formigle Posted August 23 2017. A flow-through entity is a business entity is which income of the entity passes on to the investors or owners of the entity. ASC 740 contains minimal explicit guidance on the accounting for deferred taxes associated with investments in partnerships or other flow-through entities eg LLCs.

There are many PEVC funds with limited partners such as pension funds or non-US. In an earlier article titled Rollover Equity Transactions 2019 we discussed the various business and tax issues associated with transactions involving private equity PE. In this legal entity income flows through to the owners.

Waterfall structures in commercial real estate private equity deals can be complex.

Company Registration In India Private Limited Company Business Advisor Limited Company

Private Equity Meaning Investments Structure Explanation

Pin On Doing Business In Singapore

Efinancemanagement Com Financial Management Concepts In Layman S Terms Accounting Student Accounting Education Accounting And Finance

Developing A Private Equity Fund Foundation And Structure The Giin

Developing A Private Equity Fund Foundation And Structure The Giin

Leveraged Recapitalization Meaning Pros Cons And More In 2022 Corporate Strategy Financial Management Leverage

Worker Cooperatives Origin Stories And Development Strategies Cooperation Cooperative Economics Development

What Is Decentralized Autonomous Organization Dao In A Nutshell Fourweekmba Organizational Structure Types Of Organisation Organization

Model Portfolio Subscription Model Portfolio Investing Cash Flow Statement

Model Portfolio Subscription Model Portfolio Investing Cash Flow Statement

Your Business Structure Is Your Company S Foundation How S Your Business Standing Stable Or Writing A Business Plan Business Structure Business Investment

Pin On Journal Spreads And Notes

Sources Of Finance For Small Business Finance Class Finance Accounting And Finance

Converting Sole Proprietorship To Sg Pte Ltd Company Registration Guide Sole Proprietorship Private Limited Company Small Business Management

Pass Through Entity Definition Examples Advantages Disadvantages

Economic Order Quantity Eoq Economic Order Quantity Accounting Education Website Development Process

Efinancemanagement Com Financial Management Concepts In Layman S Terms Accounting Student Accounting Education Accounting And Finance

Joint Venture Joint Venture Financial Management Financial Strategies