transfer car loan to another person uae

If it is a car loan the seller has to present the confirmation for the final loan payment. How to transfer car loan to another person in uae.

Top Up Loan On Your Existing Car Loan Bankbazaar

Ask the buyer to provide the bank with the new registration card as proof of ownership and a copy of comprehensive insurance for the financed value of the car to close the loan.

. So no matter if you are a buyer or a seller check if. If the car is still under. The car lender may opt to proceed with the.

But if you are unable to repay the loan there is an option to transfer the loan to the next person. If you have an assumable loan and want to transfer your car loan to another person talk with your lender and ensure the transferee meets credit criteria. Enter your name email address and contact details.

In any case the buyer needs to pre-arrange insurance valid for 13 months for the vehicle. An NOC No Objection Certificate obtained from the present owner of the car. A salesperson at First Bank Abu Dhabi FAB said.

The most preferred option is to close your loan account by settling the loan in advance and then selling the car. It should take less than 30 minutes and costs usually less than AED150 in Dubai. The Bottom Line on Car Loan Transfer.

If the new owner has agreed to have the loan transferred to them instead the current owner must obtain a release letter or a no-objection certificate NOC from the bank to transfer the loan to the buyer. The insurance policy must be terminated or transferred to the buyer. Customers who have a residence visa from another emirate must meet one the below conditions to register a vehicle.

Any outstanding fines must be paid off. Following is the list of required documents to complete the transfer of car insurance from one person to another. The seller should have terminated hisher insurance policy or transferred it to the buyer.

Both buyer and seller must be present during the transfer. You should be aware that you will want the authorization of the vehicle lender to execute the transaction. To be able to transfer your car loan to somebody else you need to surrender the ownership of the vehicle to them as well.

Certificate of the policy with the name of the current owner on it along with all the related documents. Alternatives to car loan transfer include deferment a straight sale or loan refinancing. The buyer will then register the car under his.

In doing so make sure your insurance policy new or existing is up to date and covers the vehicle you are registering if you are the buyer. As a result the first step is to call the lender explain the issue and make a compelling argument for moving the loan to another driver. Mention the age of the car.

Customers must visit a FAB branch to get their loans cleared this. The seller should have paid all outstanding fines. The buyer must be a resident of the UAE.

Any car loans mortgages must be paid off or transferred to the new owner. In case the car loan is still not paid off the seller has to get a release letter or a NOC from the bank. Most loans arent assumablebut there are exceptions.

It is somewhat easier to transfer a car loan to another person either with the same lender or a new one. The customer must be an investor in Dubai property or facility owner. Seeking a new lender will end up costing you more but the new borrower will likely see more benefits.

The buyer must be a UAE resident. Also when transferring ownership from one emirate to another you need to cancel the car in the original city mark it as for export and then re-register it as another car in the new town. 4 Car test.

If youre buyingselling a vehicle in the UAE youll need to have the vehicle ownership transferred in your name. The dedicated staff will get in touch with you once you fill out the online form. Make Contact With The Original Lender.

Car insurance in the name of the new buyer. What you need to transfer vehicle ownership in Dubai Here are a few things to make note of. The seller also has to offer the original passport copy and their residential visa.

Physical number plates must also be removed from the car and handed over at the registration counter. Transfer ownership of the car to the new buyer at the RTA Tasjeel. When applying for changing a vehicle ownership the customer must apply for registration export possession or transfer service.

Completed car insurance transfer forms and documents. Valid residence visa. Once you have agreed with the seller or buyer on the car transaction and arranged the funds you will need to officially transfer the ownership of the.

Gulf News spoke with banks on the procedure for getting a release letter. Also the interest rate of this loan service starts from 299 while the loan amount is up to 80 of the vehicle valuation. Have the car tested at the registration centre so you can get a pass report.

FAQs on Vehicle Ownership Transfer in UAE.

Can I Transfer My Car Loan To Another Person House Of Debt

How To Transfer A Car Loan To Another Person Finder Canada

How To Finance A Car At 0 Interest Nerdwallet

How To Get A Car Loan With Bad Credit Experian

Tips To Transfer A Car Loan To Another Person Bbalectures Com Car Loans Cheap Car Insurance Car Finance

Car Loan Options Types Of Car Loan In India Used Car Loan Vs New Car Loan

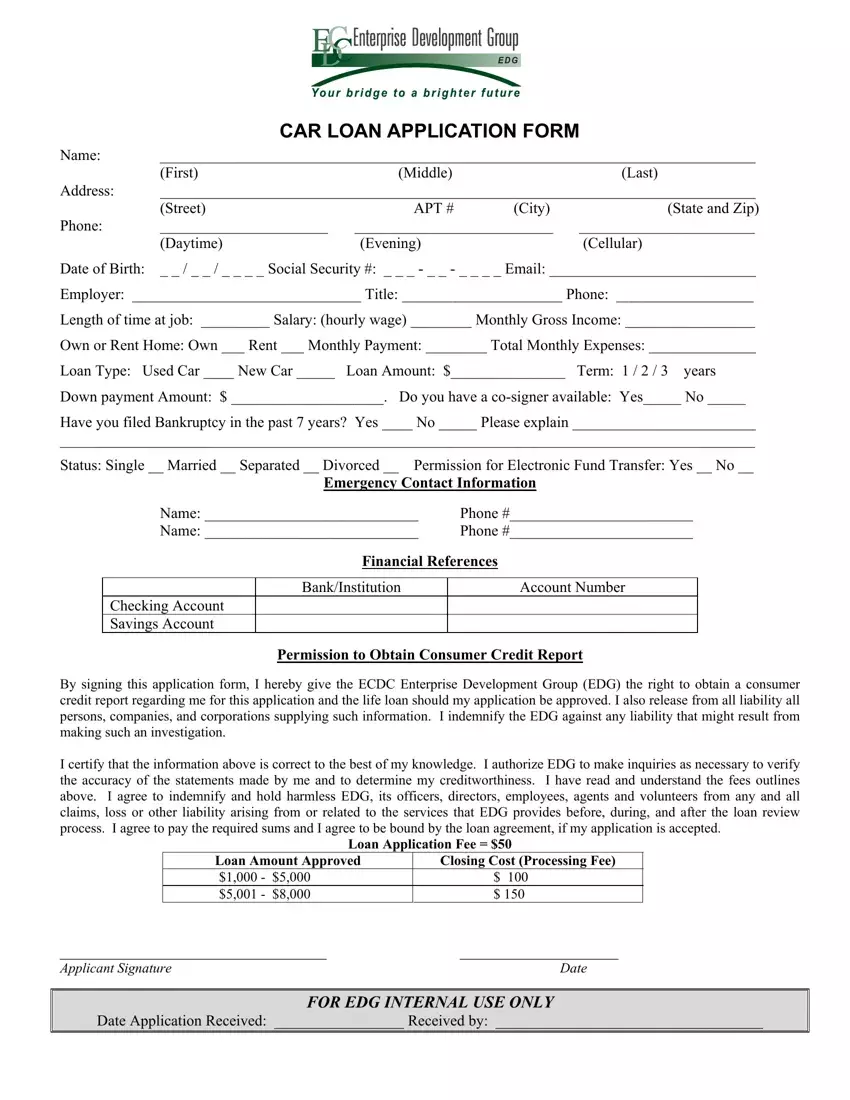

Car Loan Application Form Fill Out Printable Pdf Forms Online

How Do I Qualify For A Car Loan Experian

Car Loan Closure Procedure At All Banks

New And Previously Owned Car Loans Consumer Loans Hsbc

Dealership Vs Bank Loan Which Is The Best Way To Finance Your Car

Top 5 Car Loans For Used Cars In The Uae Mymoneysouq Financial Blog

How To Get A Used Car Loan Experian

Can You Pay A Car Loan With A Credit Card Smartasset

What S The Average Car Loan Length Credit Karma

Car Loan Payment Agreement How To Draft A Car Loan Payment Agreement Download This Car Loan Payment Agreement Templa Contract Template Car Finance Car Loans

How To Remove A Cosigner From A Car Loan